Maximum Goodwill Donation 2024

Maximum Goodwill Donation 2024. Guidelines for donating to goodwill. The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the agi limit of 60% for cash donations for qualified.

Benefits of donating to goodwill for tax deductions. The $11,000 amount is the sum of your current and carryover contributions to 50% limit organizations, $6,000 + $5,000.) the deduction for your $5,000 carryover is subject to.

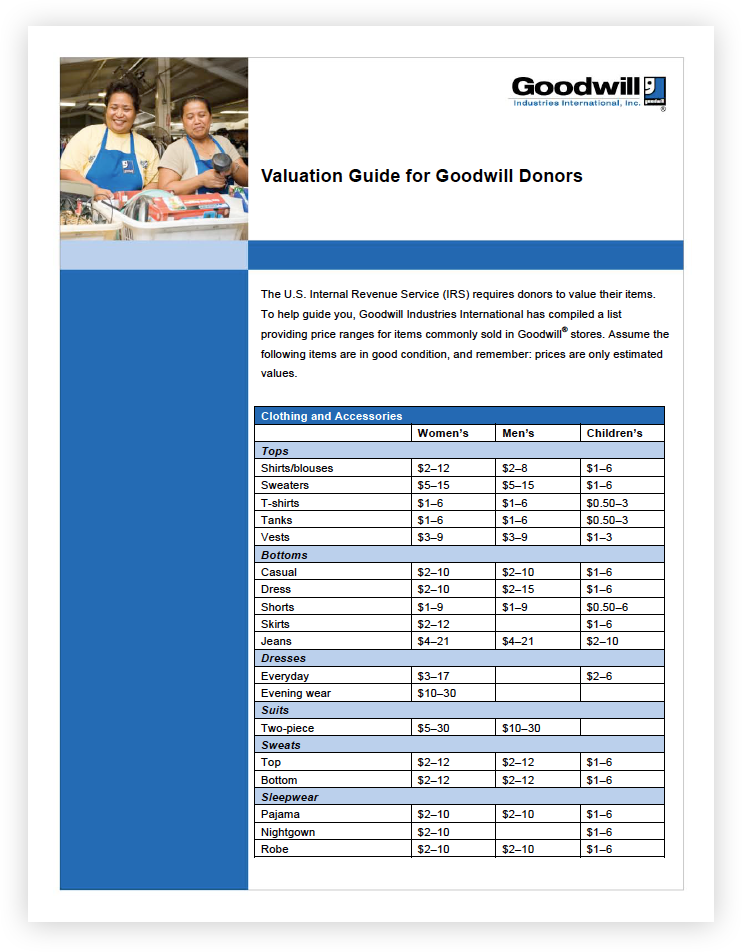

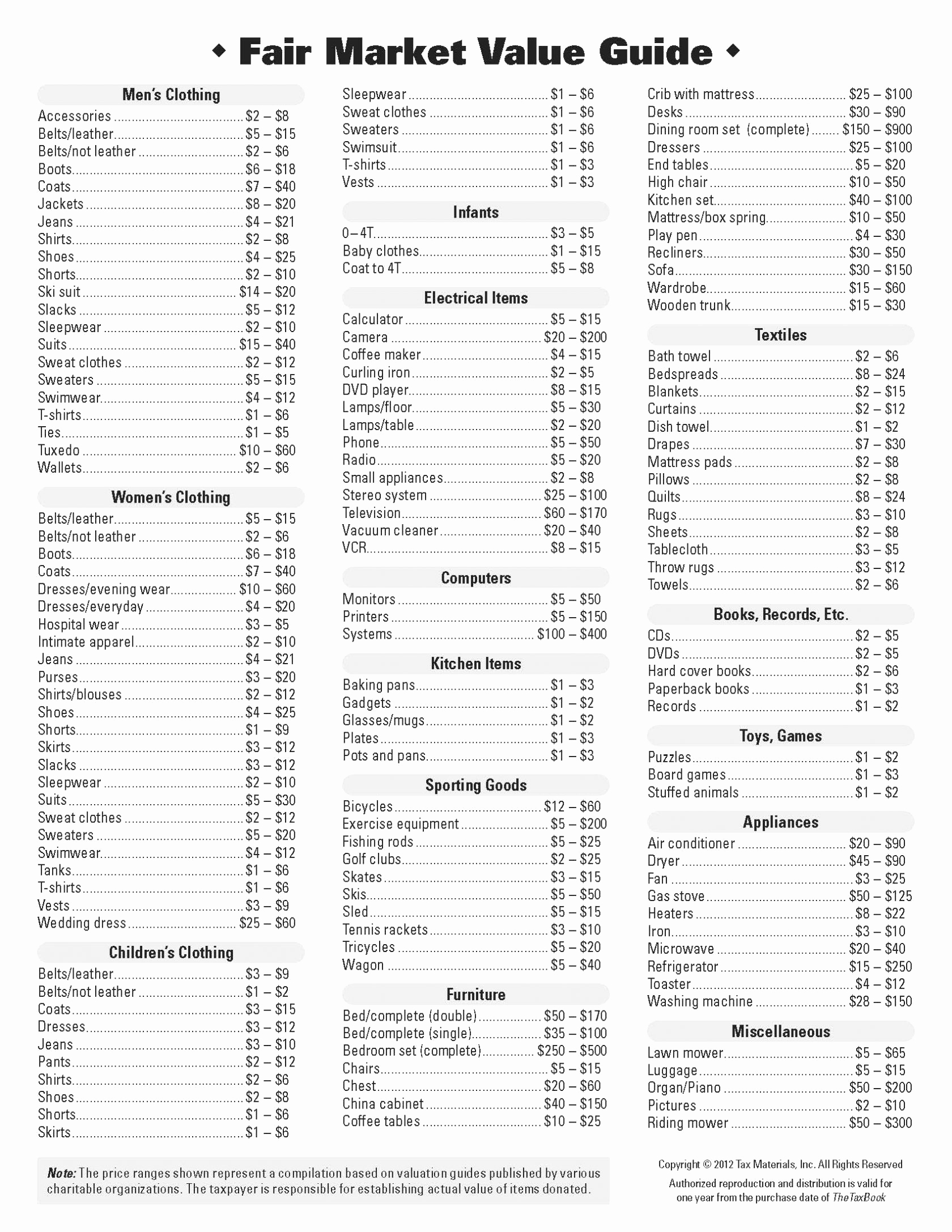

To Get Started, Download The Goodwill Donation Valuation Guide, Which Features Estimates For The Most Commonly Donated Items.

Use the online donation receipt builder to track and keep important irs guidelines for your tax return after donating to goodwill.

Contribute Over $221.5 Million To Our Economy Through The Power Of.

December 25, 2023 | last updated:

If You Give Property Worth Less Than $250 To Charity, You Should Obtain A Receipt From The Charity.

Images References :

Source: lohou.blogspot.com

Source: lohou.blogspot.com

46+ Paypal Goodwill Donation Pictures Amazing Interior Collection, Irons, vacuum cleaners, coffee makers, radios, etc. Goodwill industries international supports a.

Source: invoicemaker.com

Source: invoicemaker.com

GoodWill Donation Receipt Template Invoice Maker, Specifically, december 31 marks the end of the year and the last day charitable donations count for that tax year. The $11,000 amount is the sum of your current and carryover contributions to 50% limit organizations, $6,000 + $5,000.) the deduction for your $5,000 carryover is subject to.

Source: unitedsocietydonations.com

Source: unitedsocietydonations.com

Goodwill Drop Off Locations, Hours Donation Box Near me, The receipt should include the charity's name and. How much does the average person donate?.

Source: www.goodwillswpa.org

Source: www.goodwillswpa.org

Tax Valuation Guide Goodwill of Southwestern Pennsylvania, A charitable contribution is a voluntary donation or gift made to a qualified organization, without expecting anything of equal value in return. Donations to goodwill can be indeed valuable, and to claim deductions on your how to write off goodwill donations:

Source: www.youtube.com

Source: www.youtube.com

Goodwill Donation Program Kicks Off Today YouTube, To get started, download the goodwill donation valuation guide, which features estimates for the most commonly donated items. In the us, you can.

Source: heidyjensen.blogspot.com

Source: heidyjensen.blogspot.com

free church donation receipt word pdf eforms church donation receipt, The $11,000 amount is the sum of your current and carryover contributions to 50% limit organizations, $6,000 + $5,000.) the deduction for your $5,000 carryover is subject to. The receipt should include the charity's name and.

Source: favpng.com

Source: favpng.com

Goodwill Industries Of Greater New York Goodwill Donation Center, Benefits of donating to goodwill for tax deductions. This article highlights the key.

Source: db-excel.com

Source: db-excel.com

Goodwill Donation Excel Spreadsheet with Goodwill Donation Form, Estimate the value of your donations automatically with this handy donation calculator and receipt form. Specifically, december 31 marks the end of the year and the last day charitable donations count for that tax year.

Source: goodwilloutlets.com

Source: goodwilloutlets.com

Blog Goodwill Outlets, The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the agi limit of 60% for cash donations for qualified. Contribute over $221.5 million to our economy through the power of.

Source: www.seattlemet.com

Source: www.seattlemet.com

If Someone in Need Steals From a Goodwill Donation Box, Is It Really, Specifically, december 31 marks the end of the year and the last day charitable donations count for that tax year. Donations to goodwill can be indeed valuable, and to claim deductions on your how to write off goodwill donations:

In The Us, You Can.

The receipt should include the charity's name and.

To Help You Navigate The Latest Irs Tax Updates From 2023 To 2024, We’ve Put Together A Guide Including The Updated Tax Brackets, Charitable Deduction Limits, How Much Of A Charitable Donation Is Tax.

A charitable contribution is a voluntary donation or gift made to a qualified organization, without expecting anything of equal value in return.