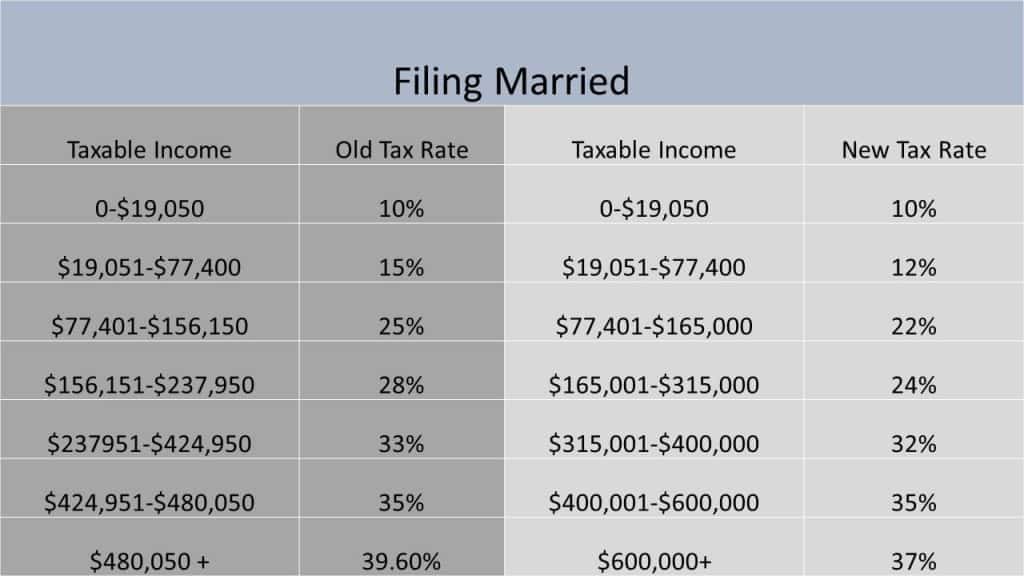

2025 Married Filing Jointly Tax Table

2025 Married Filing Jointly Tax Table. For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2023. Rates for married individuals filing separate returns are one half of the married filing jointly brackets.

Single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Remember, these aren’t the amounts you file for your tax return, but rather the amount of tax you’re going to pay starting january 1, 2025 to december 31, 2025.

2025 Married Filing Jointly Tax Table Images References :

Source: billblyndsey.pages.dev

Source: billblyndsey.pages.dev

What Are The Irs Tax Brackets For 2025 Caro Martha, Single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

Source: charlotwcollie.pages.dev

Source: charlotwcollie.pages.dev

Irs 2025 Tax Tables Married Jointly Irina Leonora, Single (under 65 years old):

Source: vevaycristen.pages.dev

Source: vevaycristen.pages.dev

Tax Bracket 2025 Married Filing Separately Meaning Glen Philly, Single, married filing jointly, married filing separately, or head of household.

Source: suevalerye.pages.dev

Source: suevalerye.pages.dev

2025 Tax Tables Married Filing Jointly Mable Atlante, The calculator automatically determines whether.

Source: www.trustetc.com

Source: www.trustetc.com

2025 Tax Brackets Announced What’s Different?, The calculator automatically determines whether.

Source: tanihyacintha.pages.dev

Source: tanihyacintha.pages.dev

2025 Tax Rates Married Filing Jointly Vs Single Naomi Virgina, 2025 us tax tables with 2025 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

Source: marketawaudi.pages.dev

Source: marketawaudi.pages.dev

2025 Tax Brackets Married Jointly 2025 Ora Virgina, Here are the 2025 federal tax brackets.

Source: candissheilah.pages.dev

Source: candissheilah.pages.dev

2025 Tax Brackets Married Jointly Jolee Madelon, This will depend on the individual’s filing status, such as.

Source: lorainewlicha.pages.dev

Source: lorainewlicha.pages.dev

2025 Tax Rate Tables Married Filing Jointly Delly Fayette, Here’s how that works for a single person with taxable income of $58,000 per year:

Source: blissqcollete.pages.dev

Source: blissqcollete.pages.dev

Federal Tax Tables 2025 Married Jointly Dulcy Glennis, Compare your take home after tax an.

Category: 2025